Over recent months, you may have noticed rising concerns from Fed officials about the economic impact of ongoing tariffs. Atlanta Federal Reserve President Raphael Bostic and others emphasize that tariffs are expected to cause a prolonged period of elevated inflation, rather than a brief price spike. As a result, they advise patience with interest rate changes, urging you to understand that the Fed is closely monitoring how tariffs and geopolitical factors influence inflation before making significant moves. This cautious approach aims to navigate uncertainty and avoid premature monetary policy shifts that could affect your financial stability.

The Inflation Dilemma: Tariffs vs. Economic Stability

The Federal Reserve’s cautious stance comes amid a growing inflation dilemma where tariffs add complexity by potentially extending price pressures well beyond an initial spike. You see, while headline inflation hovers just above the Fed’s 2% target, the hidden challenge lies in anticipating whether tariff-induced cost increases will embed into broader inflation expectations, risking destabilization. Balancing the need to support a strong labor market with containing these prolonged inflation risks demands measured patience before adjusting monetary policy in response to evolving trade tensions.

Tariff Impact: An Analysis Beyond the One-Time Spike

Atlanta Fed President Raphael Bostic highlights that tariffs are unlikely to cause merely a “short and simple one-time shift” in prices. Firms appear to be delaying substantive price hikes, signaling that the inflationary pressure from tariffs may persist over a year or more. You should consider that this prolonged elevation of costs contrasts with textbook assumptions and complicates the Fed’s approach, as price adjustments may unfold slowly and unevenly, masking immediate inflation effects while building longer-term risks.

Historical Context: Lessons from Past Trade Policies

Past trade policy episodes provide valuable insights into how tariffs can reshape inflation dynamics and economic growth. During the 1970s and early 1980s, protective tariffs combined with oil shocks contributed to sustained inflation above target levels, forcing the Fed into aggressive rate hikes that triggered recessions. In contrast, the Smoot-Hawley Tariff Act of the 1930s, while worsening the Great Depression globally, highlights how prolonged trade restrictions can stifle economic recovery and amplify market uncertainty, underscoring the delicate balance the Fed must navigate today.

Fed’s Cautious Stance: Reasons for Patience

The Fed’s decision to hold steady on interest rates reflects a deliberate choice to navigate ongoing uncertainties without rushing into policy changes. You see, the interplay of trade policy shifts, tariff impacts, and volatile economic signals demands careful observation. Atlanta Fed President Raphael Bostic emphasized that now is “no time for significant shifts” in monetary policy, highlighting the need to await clearer data. With tariffs potentially fueling prolonged inflation rather than a simple price spike, patience becomes your ally in avoiding premature moves that could unsettle markets.

The Influence of Geopolitical Factors on Rate Decisions

Geopolitical developments, including tariff disputes and diplomatic tensions, exert substantial pressure on the Fed’s rate decisions. You must weigh how trade policy uncertainties intertwine with economic indicators, blurring the Fed’s ability to predict growth and inflation trajectories. As President Barkin likened the process to “driving through fog,” such fluid conditions call for caution:

- Tariff implementation delays mask true inflationary effects

- Geopolitical risks complicate economic forecasting

- Potential policy adjustments hinge on evolving global dynamics

Thou should expect gradual navigation instead of abrupt shifts amid this haze.

Assessing Inflation Data: Waiting on the Wrong Signals

Recent inflation figures hovering slightly above the Fed’s 2% target may mislead you into underestimating tariff pressures. Bostic pointed out that firms are strategically postponing price hikes until final tariff rates are confirmed, meaning official inflation readings might not capture the impending impact. This lag in observable data urges restraint in policy moves, as premature action risks responding to signals that don’t yet reflect the economy’s true inflationary environment.

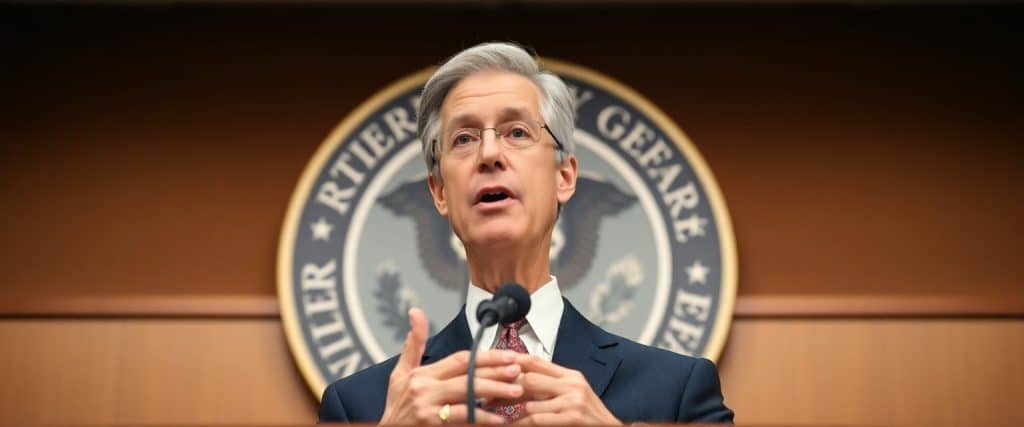

Key Players and Perspectives: Insights from Fed Officials

The Fed’s current stance reflects a cautious balancing act, with key officials emphasizing patience amid tariff-driven uncertainty. Jerome Powell, Raphael Bostic, and Tom Barkin each underscore the difficulty in gauging the full impact of tariffs on inflation and growth, advocating for a measured approach to monetary policy. Their insights reveal a shared belief that the economy requires close monitoring before any significant rate changes occur, highlighting ongoing debates within the Federal Reserve about navigating an evolving landscape shaped by trade tensions and geopolitical risks.

Jerome Powell’s Testimony and Its Implications

In his testimony, Chair Powell confirmed the Fed’s deliberate pause on rate cuts due to rising tariff pressures, stating the central bank would have likely resumed easing without these trade barriers. He underscored that the size and scope of tariffs necessitate a cautious approach, signaling that inflation risks have complicated the Fed’s typical response. This stance effectively signals to markets that monetary policy will remain data-dependent, with potential adjustments contingent on how trade policies evolve in the coming months.

Raphael Bostic and Tom Barkin on Navigating Uncertainty

Both Bostic and Barkin advise caution, portraying the Fed’s policy navigation amid tariffs as akin to “driving through fog.” Bostic points to a likelihood of prolonged inflation tied to trade and geopolitical factors, while Barkin stresses incremental decision-making given the unknown economic impact. Together, their views emphasize a watchful stance, urging you to anticipate slow, deliberate moves rather than abrupt shifts in interest rates until clearer signals emerge.

Digging deeper, Bostic highlights recent inflation data slightly above the 2% target but warns this masks delayed price increases by firms awaiting tariff finalizations, suggesting inflation pressures may intensify. Barkin’s “fog” metaphor captures the Fed’s struggle to interpret these ambiguous signals without clear visibility on policy outcomes. Their combined perspectives warn you not to expect rapid policy reactions soon, as the Fed prioritizes gathering more evidence—particularly with the pivotal July FOMC meeting and tariff deadlines looming.

The Road Ahead: What to Expect from the Federal Reserve

As you track developments, anticipate the Fed maintaining a cautious stance amid tariff uncertainties and mixed economic signals. Inflation hovering just above 2% alongside steady job growth suggests the Fed will continue its current wait-and-see approach, avoiding major policy shifts until clearer data emerges. The combination of geopolitical tensions and trade policy changes means inflation pressures may persist longer than usual, making patience key in the Fed’s strategy moving forward.

Upcoming FOMC Meetings and Their Significance

The July 29-30 FOMC meeting will be closely watched, especially with Trump’s tariff pause ending July 9. Your focus should be on any guidance around how tariff resolutions might influence inflation trends. Fed officials, including non-voting members like Bostic, have signaled no immediate rate changes, emphasizing caution as they digest fresh data amid geopolitical uncertainty and evolving trade deals expected to be announced shortly.

Potential Scenarios: Rate Cuts, Tariff Resolutions, and Economic Growth

You could see a scenario where the Fed resumes rate cuts if tariffs ease and inflation pressures diminish, boosting economic growth. Alternatively, sustained or escalating tariffs might compel the Fed to hold rates steady or even consider hikes if inflation spikes. Continued robust job growth with a 4.1% unemployment rate suggests the economy has resilience, but delayed price increases hint at underlying inflation risks that could alter the Fed’s trajectory.

Delays in tariff-driven price hikes, as firms wait for final rates to be set, might temporarily mask inflation but could lead to protracted price increases later. If trade tensions ease post-July 9, the Fed could revert to cutting rates to stimulate growth more aggressively, resuming the cycle it paused earlier due to tariff uncertainties. Conversely, a failure to resolve trade disputes may force the Fed to prioritize inflation containment over easing, even if that risks slowing growth. Your strategy should account for these intertwined possibilities as the Fed navigates an unusually complex economic landscape.

Final Words

With these considerations, you should understand why Fed officials are urging patience on rate decisions amid ongoing tariff uncertainty. They emphasize the importance of closely monitoring how trade policies and geopolitical factors influence inflation and the broader economy before making significant moves. As you follow these developments, recognize that the Fed’s cautious approach aims to balance economic growth with price stability, ensuring that your financial environment remains as steady as possible during these unclear times.

Frequently Asked Questions

Why is the Federal Reserve holding interest rates steady?

The Federal Reserve is maintaining current interest rates to assess the economic impact of recent tariffs and to ensure that inflation remains under control. Officials emphasize a cautious approach amid economic uncertainty.

How have recent tariffs affected inflation expectations?

Recent tariffs have led to increased inflation forecasts, prompting the Federal Reserve to pause rate cuts until the full impact on prices and economic activity is clearer.

What is the Federal Reserve’s current interest rate policy?

The Federal Reserve has kept its benchmark interest rate in the 4.25% to 4.5% range since December 2024, opting for a wait-and-see approach to gather more data before making further adjustments.

When can we expect the Federal Reserve to reconsider rate cuts?

The Federal Reserve plans to evaluate economic data over the summer, with potential rate cuts considered later in the year if inflation remains subdued and economic growth continues.

What are the risks of delaying rate cuts?

Delaying rate cuts could lead to prolonged inflationary pressures if tariffs continue to affect prices. However, premature rate reductions without clear economic signals could also destabilize the economy.