It’s important you understand how this massive tax and spending bill will impact your life, whether you rely on Medicaid, food assistance, or tax breaks. Millions could lose healthcare coverage due to new work requirements, while those who buy American-made cars may benefit from deducting interest payments. Parents will see a bigger child tax credit, but you might face tougher rules if you need help affording food or insurance. With changes affecting everything from student loans to hospital funding, this bill’s effects reach far into your daily life.

The Ripple Effect on Health Coverage

The bill’s heavy cuts and new rules ripple through the health coverage landscape, impacting not just those directly enrolled in government programs but also hospitals and communities relying on their services. By tightening Medicaid funding and adding work mandates, it could leave millions uninsured or underinsured. Hospitals, especially in rural areas, warn of closures, staff reductions, and limited services as a result. These changes may force you to navigate a more complex, less accessible system when seeking care, whether or not you currently receive assistance.

Medicaid Overhaul: New Requirements and Potential Loss of Coverage

New work requirements mean if you’re aged 19 to 64 and enrolled through Medicaid expansion, you’ll need to work, volunteer, attend school, or do job training for 80 hours a month to keep coverage. Parents of children 14 and older face the same mandate. On top of that, eligibility reviews would happen more often, and you might pay up to $35 for certain care. With states receiving less federal aid, many could cut benefits or restrict enrollment, putting your access at significant risk.

Impact on the Affordable Care Act: Increased Enrollment Barriers

Obtaining coverage on Obamacare exchanges would get tougher as the bill ramps up verification requirements and ends automatic reenrollment. This means you’d have to jump through more hoops every year, increasing the chance of losing federal subsidies that make premiums affordable. The Congressional Budget Office estimates that millions could lose coverage due to these hurdles, translating to fewer safety nets for you and millions of others relying on these plans.

Unlike previous streamlined enrollment processes, the bill suspends key Biden-era policies designed to make signing up easier and maintaining insurance seamless. Tools like auto-renewal are scrapped, demanding continuous, active participation from you to stay insured. This shift will likely increase paperwork and administrative burdens, disproportionately affecting low-income households and those less familiar with complex health systems. As a result, the increased barriers could push many into the uninsured category, escalating your healthcare costs and limiting access to preventive services or treatment.

The Food Safety Net at Risk

The bill’s expansion of work requirements for food assistance targets adults 55 and older, parents of teenagers, veterans, and others, threatening to reduce SNAP enrollment. States will now have to share more of the cost and administrative burden, pushing many to tighten eligibility or reduce benefits. As a result, you may see fewer neighbors, family members, or even yourself qualifying for or receiving full food support, especially in communities struggling with poverty or unemployment. This undercuts vital help for millions who rely on the program for basic nutrition.

Tightened Eligibility and Work Mandates for SNAP Recipients

Expanding SNAP’s work mandates means you or people in your community aged 55 to 64, parents of kids 14 and older, veterans, and more must meet stricter requirements—such as working or job training—to maintain benefits. Failure to comply could result in losing aid, even if you’re already facing hardship. This shift not only increases pressure on recipients to find employment but also raises the risk of hunger among vulnerable groups, reducing the program’s reach just as food insecurity remains high nationwide.

Implications for State Governments and Local Food Access

States are positioned to bear greater financial responsibility for SNAP benefits and their administration, forcing tough budget choices. Many may respond by cutting benefits, restricting eligibility, or even withdrawing from the program, threatening your access to food assistance. Local grocers and markets, especially in rural or underserved areas, could face reduced business, jeopardizing jobs and food availability. The ripple effect may increase food deserts and economic strain in communities already struggling to secure affordable groceries.

Taxpayer Experience in a Changing Landscape

Extending the 2017 Trump tax cuts means you’ll likely see a continuation of lower individual tax rates and an expanded standard deduction on your returns, preserving the tax relief you’ve grown used to. While many benefits remain unchanged, new elements like a boosted child tax credit and a temporary increase in state and local tax deduction caps could impact your bottom line. However, the overall tax savings—estimated at an average of $2,900 per household—will vary depending on your income bracket, making personalized planning more important than ever.

Extensions of Tax Cuts: What to Expect in Your Next Filing

Your upcoming tax filings will reflect the permanent extension of nearly all individual tax cuts from the 2017 law. This includes the continued lower tax brackets and nearly doubled standard deduction, which simplify filing and could lower your taxable income. If you’re a parent, expect that larger $2,200 child tax credit to help lower your tax bill. However, some temporary increases, like the expanded cap on state and local taxes, will phase out after a few years, so you’ll want to stay alert on those timelines.

Targeted Tax Relief: Professional Insights for Different Income Brackets

High earners might benefit less from standard deduction expansions but could see relief through temporary measures like the increased cap on state and local tax deductions. Middle-income taxpayers often gain the most from the perpetuation of the 2017 tax cuts and the larger child tax credit. Lower-income individuals might see minimal direct tax benefit but could be impacted indirectly by cuts to social safety net programs that could affect overall household finances.

Diving deeper, professionals emphasize that taxpayers in the top income brackets—earning above $200,000 individually or $400,000 jointly—should especially monitor phaseouts on credits like the child tax credit. Middle earners may enjoy consistent benefits but should prepare for potential policy shifts affecting deductions beyond 2028. Lower-income taxpayers face a complex landscape since while their tax cuts persist, changes in Medicaid and SNAP eligibility might reduce overall household support, indirectly affecting their financial position. Tax planning advice increasingly stresses the need for tailored strategies that consider these evolving thresholds and sunset provisions to optimize your tax liability under this bill.

Education and Student Debt Revisions

The bill introduces significant shifts in both student lending and university taxation. Caps on graduate and parent borrowing tighten your options for federal student loans, while repayment programs become much more limited compared to Biden-era forgiveness efforts. At the same time, selected private universities with massive endowments face a steep tax hike, altering the financial landscape for elite institutions and potentially impacting their fundraising and scholarships.

Federal Student Loan Changes: Impacts on Borrowing and Repayment

You’ll encounter new federal limits on how much can be borrowed for graduate school and parent PLUS loans, restricting access to larger loan amounts. Deferments and forbearance opportunities will decrease, and options for repayment plans narrow sharply. The shift steers away from widespread loan forgiveness, requiring you to navigate a more rigid and potentially burdensome repayment path if you’re carrying student debt.

Wealthier Universities Face Increased Taxes on Endowments

Private universities with endowments exceeding $2 million per enrolled student will see their endowment income tax rise dramatically, jumping from 1.4% to as high as 8%. This targets elite institutions like Harvard, Yale, and Stanford, sharply increasing their tax liabilities and possibly affecting their financial aid and research budgets.

New Financial Initiatives for Families

The bill introduces several financial measures aimed at supporting families, especially parents and children. Notably, it permanently increases the child tax credit and launches a pilot program that provides newborns with an initial government-funded investment account. These initiatives are designed to offer both immediate relief through tax breaks and long-term financial support beginning at birth. While these help many families, they’re paired with tighter eligibility requirements for other assistance programs, meaning some parents might find themselves juggling benefits amid new work mandates.

Enhanced Child Tax Credits: A Boost for Parents

You’ll benefit from a permanent increase in the child tax credit, raised from $2,000 to $2,200 per child. This expanded credit applies to single parents earning up to $200,000 and married couples earning up to $400,000, before beginning to phase out at higher incomes. The larger credit offers meaningful tax relief for many households, providing families more financial breathing room throughout the year, although parents with children aged 14 or older still face new work requirements to maintain other support like Medicaid and SNAP.

Nest Eggs for Future Generations: An Innovative Approach for Newborns

Every American baby born between 2025 and 2028 would receive a $1,000 government-funded “Trump account”, invested in an index fund. Parents can contribute up to $5,000 annually, with earnings compounding over time. Funds remain locked until the child reaches 18, offering a substantial financial head start. This pilot program aspires to build generational wealth and financial literacy, potentially helping children start adulthood with savings for education, a home, or other opportunities.

This program resembles proposals championed by figures across the political spectrum, with its indexed investment strategy aimed at growing initial deposits significantly over years. By creating these government-backed savings accounts, the bill attempts to address wealth inequality from birth, encouraging families to invest early. While the pilot runs only for four years, its impact could set a precedent for future bipartisan efforts to support financial security and opportunity among young Americans.

To wrap up

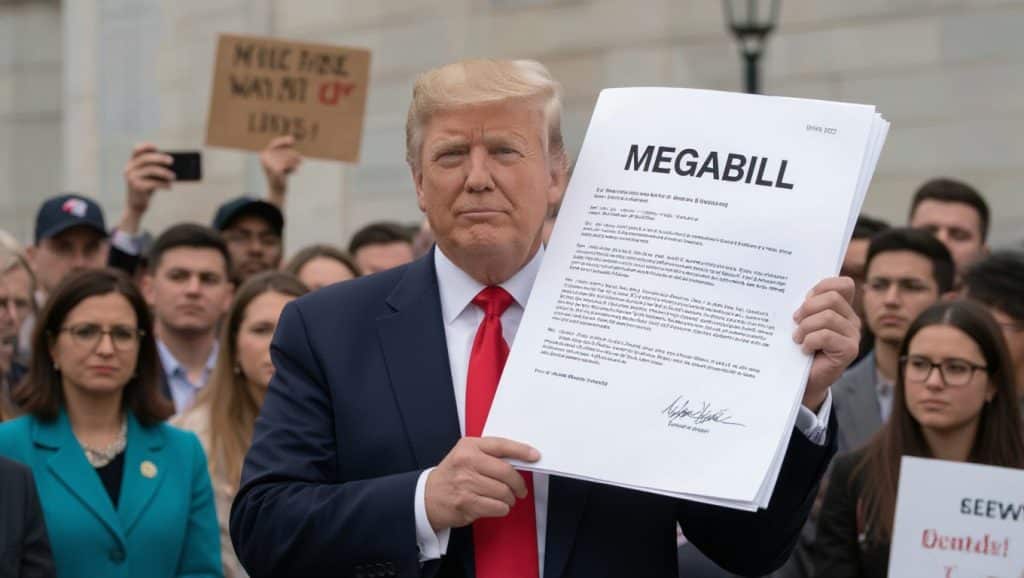

Drawing together the key points, Trump’s Megabill will impact you in multiple ways, from extending tax cuts that may lower your tax bill to imposing new work requirements if you or your family rely on Medicaid or food assistance. You might see changes in healthcare access, education loans, and benefits for children, while state services could also shift due to funding adjustments. Understanding these effects will help you navigate how the legislation influences your finances, health coverage, and community resources moving forward.