Most global traders and policy watchers are now facing heightened uncertainty as President Donald Trump threatens new tariffs on any nation supporting the ‘anti-American’ policies of the BRICS group. You should understand that this move targets both existing and potential trade partners, signaling a significant shift in U.S. trade strategy amid ongoing negotiations. With the July 9 deadline for reciprocal tariff deals approaching, your awareness of how this could impact international trade dynamics and economic risks is crucial.

The Overview of BRICS and Its Rising Influence

BRICS represents a coalition of major emerging economies challenging the traditional global order. By promoting a multipolar world where power is shared beyond Western dominance, the group leverages its combined economic strength to reshape international trade, finance, and diplomatic relations. You’ll notice that its growing influence is supported by initiatives like cross-border payments and cooperation on development projects, positioning BRICS as a pivotal force in global affairs amid ongoing geopolitical tensions.

The Founding Members and Their Goals

Brazil, Russia, India, China, and South Africa launched BRICS with the shared objective of rebalancing global economic power. Each founding member brings unique economic and political weight, united in advocating for fairer representation in institutions like the IMF and World Bank. Their goals focus on enhancing trade among themselves, reducing dependency on Western financial systems, and promoting development driven by local currencies rather than relying on the US dollar.

Recent Expansion and Membership Dynamics

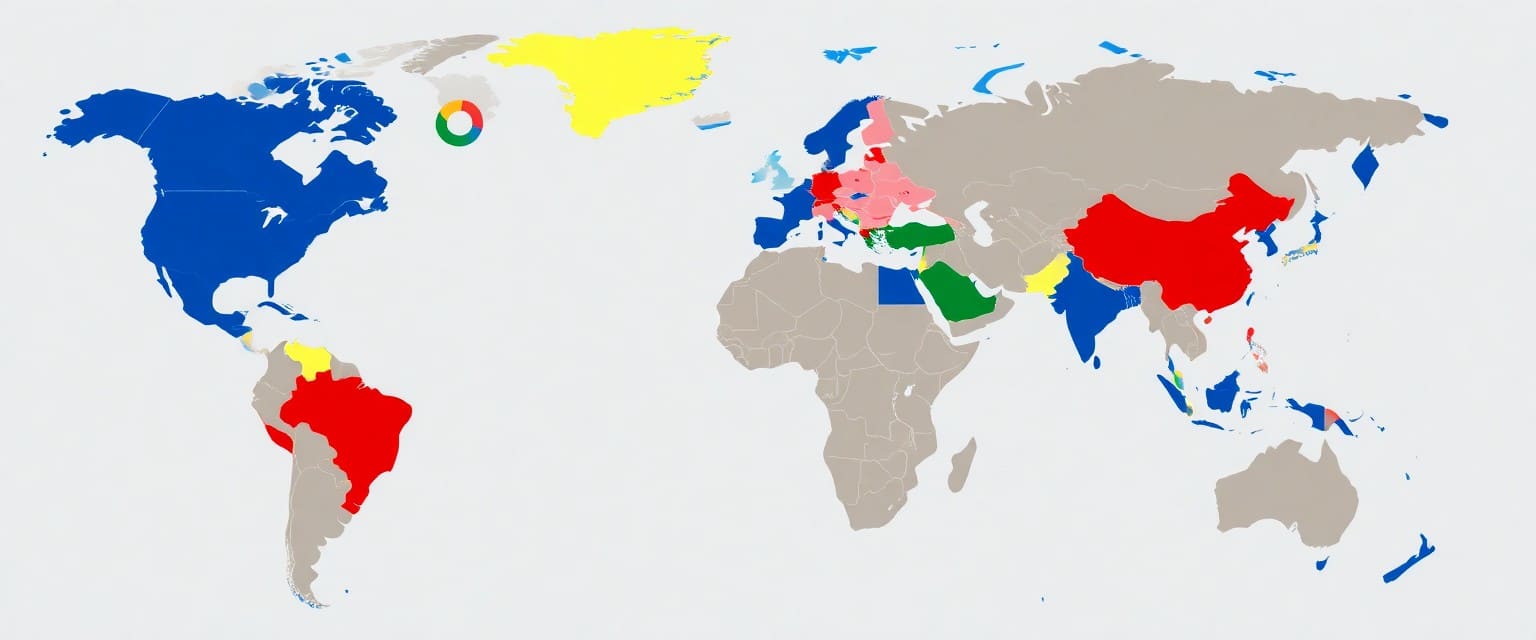

BRICS has expanded to include Egypt, Ethiopia, Indonesia, Iran, and the United Arab Emirates, with over ten partner states such as Belarus, Nigeria, Thailand, and Vietnam. This widening membership broadens the group’s geopolitical reach and economic clout, enhancing its potential to influence global markets and standards. You should observe that this inclusiveness also creates complexity, as members have diverse political agendas, economic sizes, and foreign policy orientations, which sometimes complicates unified action.

Delving deeper, the expansion signals BRICS’s ambition to become a comprehensive network of emerging markets, countering Western alliances. Egypt and Iran’s entry, for example, introduces players with strategic regional influence and political sensitivities. Indonesia and the UAE contribute sizable economies and bridge Asia with the Middle East. Meanwhile, partner nations such as Belarus and Nigeria reflect BRICS’s outreach into Europe and Africa. This diversity boosts BRICS’s bargaining power, yet the heterogeneity also forces constant negotiation to align priorities—especially on contentious issues like trade policies, sanctions, or defense cooperation.

Trump’s New Tariff Threat: Context and Implications

As the July 9 deadline nears, Trump’s renewed tariff threat adds significant tension to ongoing U.S. trade negotiations. The administration plans to send out roughly 100 tariff letters to countries by July 9, with tariff rates ranging from the existing 10% baseline up to potentially 70%, though major partners are unlikely to face the highest duties. This aggressive posture aims to pressure nations into swift trade deals, leveraging America’s position as the world’s largest economy amid concerns over the expanding BRICS bloc and its challenge to the current global order.

Trump’s Statement and Tariff Conditions

Trump announced via Truth Social that the US will impose an additional 10% tariff on any country supporting what he called the “anti-American policies of BRICS,” applying this with “no exceptions.” Letters detailing tariff rates will start arriving on July 7, with effective dates set for August 1 if no agreements are reached. While the highest tariffs discussed are as steep as 70%, Treasury Secretary Scott Bessent clarified that such extreme rates won’t apply to leading trade partners, signaling a targeted but firm approach to bilateral negotiations.

Historical Context of U.S. Tariff Policies

You should note that Trump’s use of tariffs continues a long American tradition of using protectionist measures as leverage in trade disputes. Historically, tariffs have served both as revenue tools and strategic pressure points, most notably during periods like the Smoot-Hawley Tariff of 1930. The recent spike in U.S. tariffs under Trump reflects this legacy while adapting for a multipolar economic world challenged by groups like BRICS.

The Reaction from BRICS Nations

The BRICS nations have responded to Trump’s tariff threats with a mix of caution and condemnation, highlighting growing tensions in global trade. China’s Foreign Ministry emphasized that BRICS fosters cooperation without targeting countries and firmly opposes tariff wars as tools of coercion. Brazil’s summit declaration pointedly criticized unilateral tariff actions, expressing “serious concerns” about rising protectionism. Meanwhile, various BRICS members have called attention to the destabilizing effects these new US tariffs could have on international economic relations, signaling a determined front against policies they perceive as damaging to fair trade.

Responses from Individual BRICS Leaders

Brazilian President Luiz Inácio Lula da Silva reaffirmed the group’s focus on multipolar economic governance and rejected protectionist measures, while China’s spokesperson Mao Ning warned that arbitrary tariffs harm all parties involved. India’s trade officials have remained engaged in ongoing negotiations, suggesting a preference for dialogue over escalation. Russian and South African leaders echoed concerns over the disruptive nature of these threats, emphasizing diplomatic solutions and regional cooperation as tools to counteract the impact of additional US tariffs.

The Collective Stance Against Tariffs

BRICS collectively denounced the US tariff threats as undermining international trade stability, reflecting a united opposition to unilateral economic measures. Their recent joint declaration underscored a commitment to resisting “rise of unilateral tariff and non-tariff measures” and highlighted efforts to deepen intra-BRICS trade and financial mechanisms as alternatives to Western-dominated systems.

The group’s coordinated position reinforces their long-term goal of reshaping global economic governance through multipolarity rather than confrontation. This includes advancing initiatives like cross-border payment systems to reduce reliance on the US dollar and establishing localized trade frameworks that buffer against tariff shocks. Their unified message signals to you that these countries aim to mitigate US economic pressure by building resilient, internal markets and insisting on multilateralism over coercion.

Economic Ramifications of Increased Tariffs

As tariffs resume and potentially escalate, you can expect heightened costs across various trade sectors. The rollback to previous tariff levels or new impositions at 10% or higher will disrupt supply chains and could provoke retaliatory measures. Businesses reliant on imported goods may face squeezed margins, while exporters to the US might lose market access. Such moves risk exacerbating global economic uncertainty, particularly affecting countries linked to BRICS and those negotiating trade deals. This evolving tariff landscape places you, as a consumer or trader, at the center of escalating trade frictions that could reshape pricing, sourcing, and competitiveness.

Projected Impact on Consumers and Businesses

Consumers will likely see increased prices on everyday goods as tariffs raise import costs, pushing companies like Walmart to pass these expenses on. Businesses face tougher choices: absorb higher costs or raise prices, risking lost demand. Supply chains become less predictable, and companies with exposure to BRICS-linked imports may reconsider sourcing strategies. Although some argue that foreign producers bear tariff costs, evidence shows that inflationary pressures do emerge gradually, impacting both consumer wallets and corporate profitability.

Analysis of Economic Responses from Experts

Economic experts remain divided, with former Treasury Secretary Larry Summers warning tariffs will fuel inflation and reduce US producers’ competitiveness. Conversely, administration advisor Stephen Miran highlights consistent tariff revenues and healthy job creation, disputing significant inflationary impacts. Despite this, you should note that wholesale inflation ticks up amid costlier goods, signaling underlying pressures. Treasury Secretary Scott Bessent’s dismissal of inflation concerns as “tariff derangement syndrome” contrasts with other analysts highlighting the long-term risks to growth and market stability.

Navigating Global Trade in a Multipolar World

The shift toward a multipolar global economy, led by emerging BRICS powers, challenges the traditional West-centric trade framework you’ve known. With BRICS expanding membership and promoting local currency settlements, you face a complex landscape where economic alliances and trade routes are rapidly evolving. This demands a dynamic approach to trade negotiations and strategic partnerships as the US leverages tariffs to assert influence, introducing unpredictability that affects supply chains and market access across continents.

Strategies for BRICS Nations Amidst U.S. Pressure

BRICS countries bolster efforts to diversify trade and reduce dependence on the US dollar, accelerating cross-border payment initiatives and strengthening regional trade agreements. You observe nations like India actively negotiating with the US while balancing commitments to BRICS principles, signaling a cautious pragmatism. Leveraging their combined market power, BRICS members seek to insulate themselves from tariff shocks by deepening intra-group cooperation and expanding partnerships with lower-tier partners across Africa and Asia.

The Future of International Trade Relations

Trade relations are set to become more fragmented yet interdependent, as protectionist policies from the US clash with BRICS’ vision of multipolarity. You will see an increase in bilateral deals, alternative payment systems, and currency swaps challenging dollar dominance. The risk of retaliatory tariffs and escalating trade tensions introduces volatility, but also creates openings for innovation in trade finance and supply chain resilience that savvy market participants can exploit.

Emerging trade models signal a departure from exclusively Western-led institutions toward a more diversified architecture involving multiple power centers. BRICS’ pursuit of a joint currency and local currency financing, while still in early stages, epitomizes efforts to reshape norms. Meanwhile, the US’s application of “maximum pressure” tactics through tariffs serves as a strategic lever to push countries into negotiations, though it risks alienating key partners. This evolving environment urges you to closely monitor geopolitical moves, adapt to new trade mechanisms rapidly, and anticipate shifts in global demand patterns to maintain competitive advantage.

To wrap up

Hence, you should be aware that President Trump’s threat to impose new tariffs on nations supporting the “anti-American” policies of BRICS injects added uncertainty into global trade dynamics. As these emerging economies expand their influence, you might see increased volatility affecting international markets and negotiations. Understanding this evolving situation can help you anticipate potential shifts in trade relationships and economic policies that could impact your business or investments moving forward.